Risk-Based Diversification

Low Risk: Stability First

- Stablecoin Strategies: Auto-allocate to USDC, DAI using PCA (Principal Component Analysis) to maintain peg stability.

- Blue-Chip Exposure: ETH/BTC Staking: Optimized rewards with impermanent loss hedging.

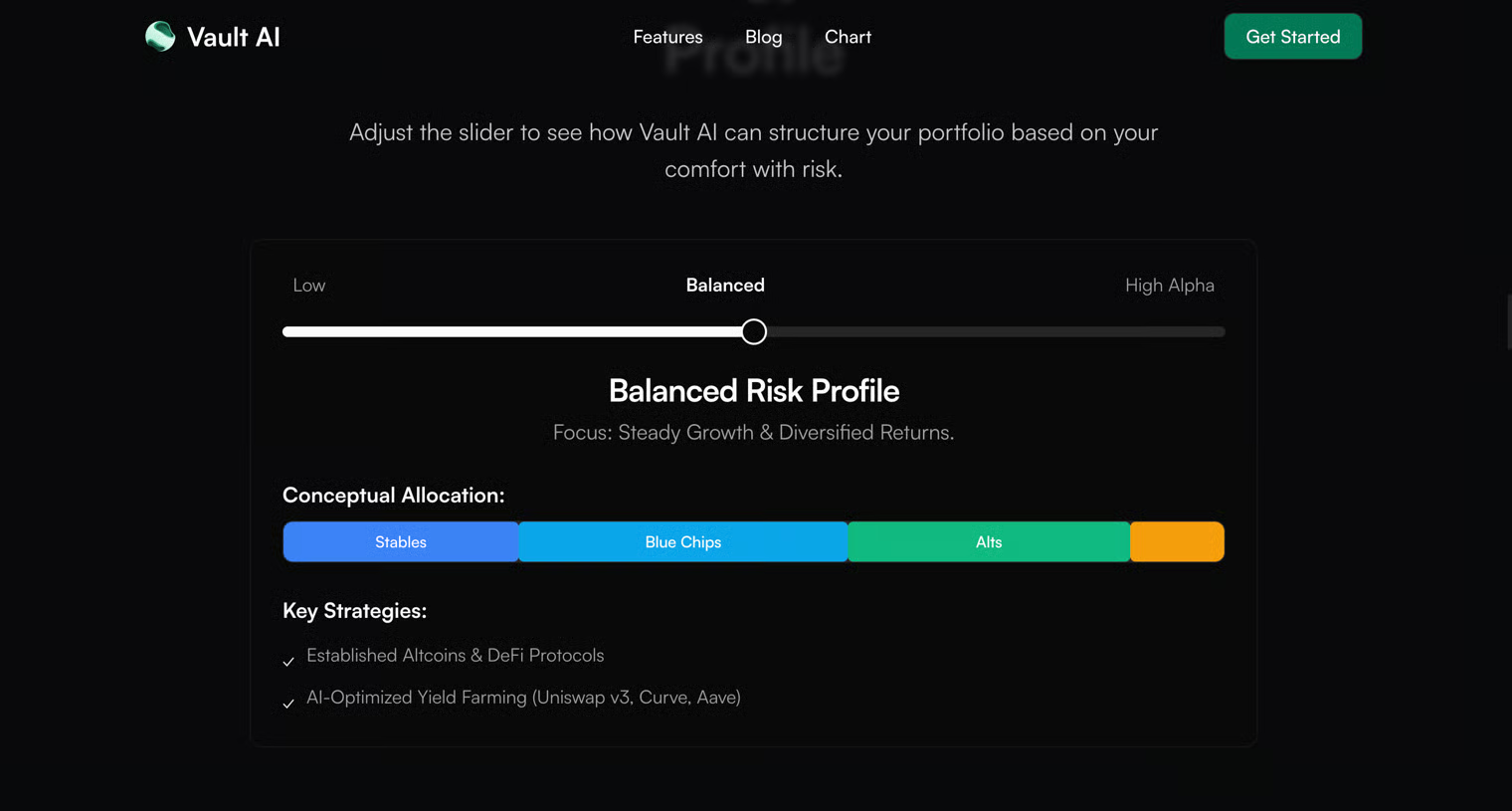

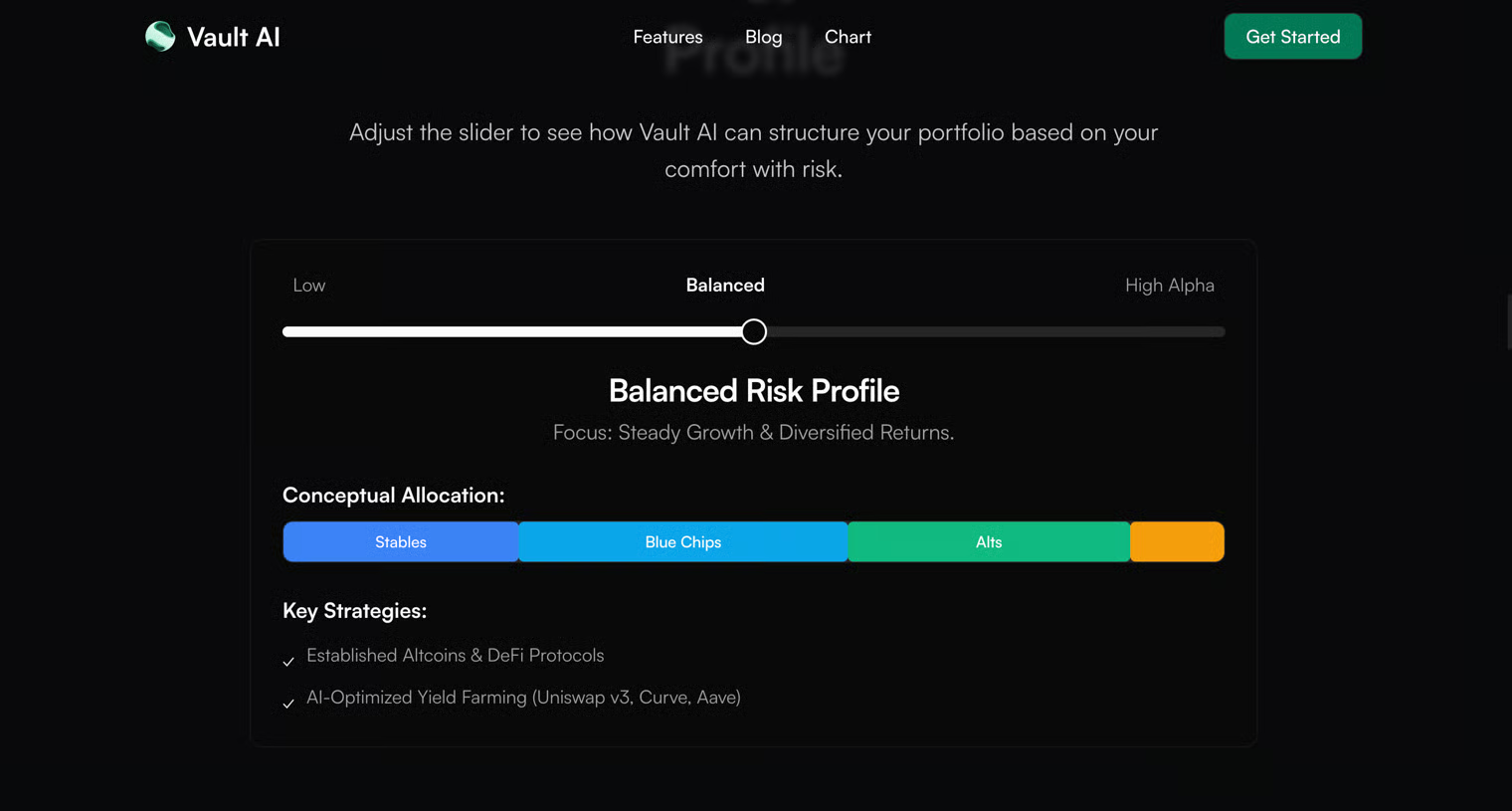

Mid Risk: Balanced Growth

- Liquidity Pools: Deploy capital to Uniswap v3/Curve with concentrated liquidity algorithms to minimize slippage.

- Yield Farming: Rotate between Aave, Compound, and Morpho using k-means clustering to identify sustainable APYs.

High Risk: Frontier Alpha

- Narrative Surfing: XAI Social Graphs: Detect trending tokens (e.g., $SCAM) from Twitter hype cycles using RoBERTa-Large.

- Meme Coin Engine: GPT-4o generates virality scores for tokens based on ticker symbolism and community hype.